6

through the business. However, it is a feature of the tax system

that other businesses (including all corporates) must include

in their turnover for the year the value of incomplete work, of

unpaid bills (debtors) and of work completed but not yet billed,

all as at the end of the year.

We will need to discuss with you exactly what needs to be

identified and the basis of valuation. Keeping an eye on debtors

and unbilled work is very important to your cash flow.

Limited companies

Forming a limited company may be a consideration if the

limitation of liability is important, but it should be noted that

banks and other creditors often require personal guarantees

from directors for company borrowings.

Trading through a limited company can be an effective way

of sheltering profits. Profits paid out in the form of salaries,

bonuses, or dividends may be liable to top tax rates, whereas

profits retained in the company will be taxed at 20%.

Funds retained by the company can be used to buy equipment

or to provide for pensions – both of which can be eligible for

tax relief. They could be used to fund dividends when profits are

scarce (spreading income into years when you might be liable to

a lower rate of income tax) or capitalised and potentially taxed

at 10% and/or 20% on a liquidation or sale.

From April 2016, a new system of taxation applies to dividends

and this has reduced the potential tax savings available. We

would be happy to discuss the implications of incorporation

with you, before you decide whether or not to incorporate

your business.

National insurance contributions (NICs)

Leaving profits in the company may be tax-efficient, but you

will of course need money to live on, so you should consider the

best ways to extract profits from your business.

A salary will meet most of your needs, but you should not

overlook the use of benefits, which could save income tax and

could also result in a lower NIC liability.

Five NIC-saving strategies:

1. Increasing the amount the employer contributes to company

pension schemes. Care should be taken however as there are

limits on the amount of pension contributions an individual

can make both annually and over their lifetime

2. Share incentive plans (shares bought out of pre-tax and

pre-NIC income)

3. For some companies, disincorporation and instead operating

as a sole trader or partnership may be beneficial

4. Instead of an increased salary, paying a bonus to reduce

employee (not director) contributions

5. Paying dividends instead of bonuses to owner-directors.

Increasing your net income as an

owner-director

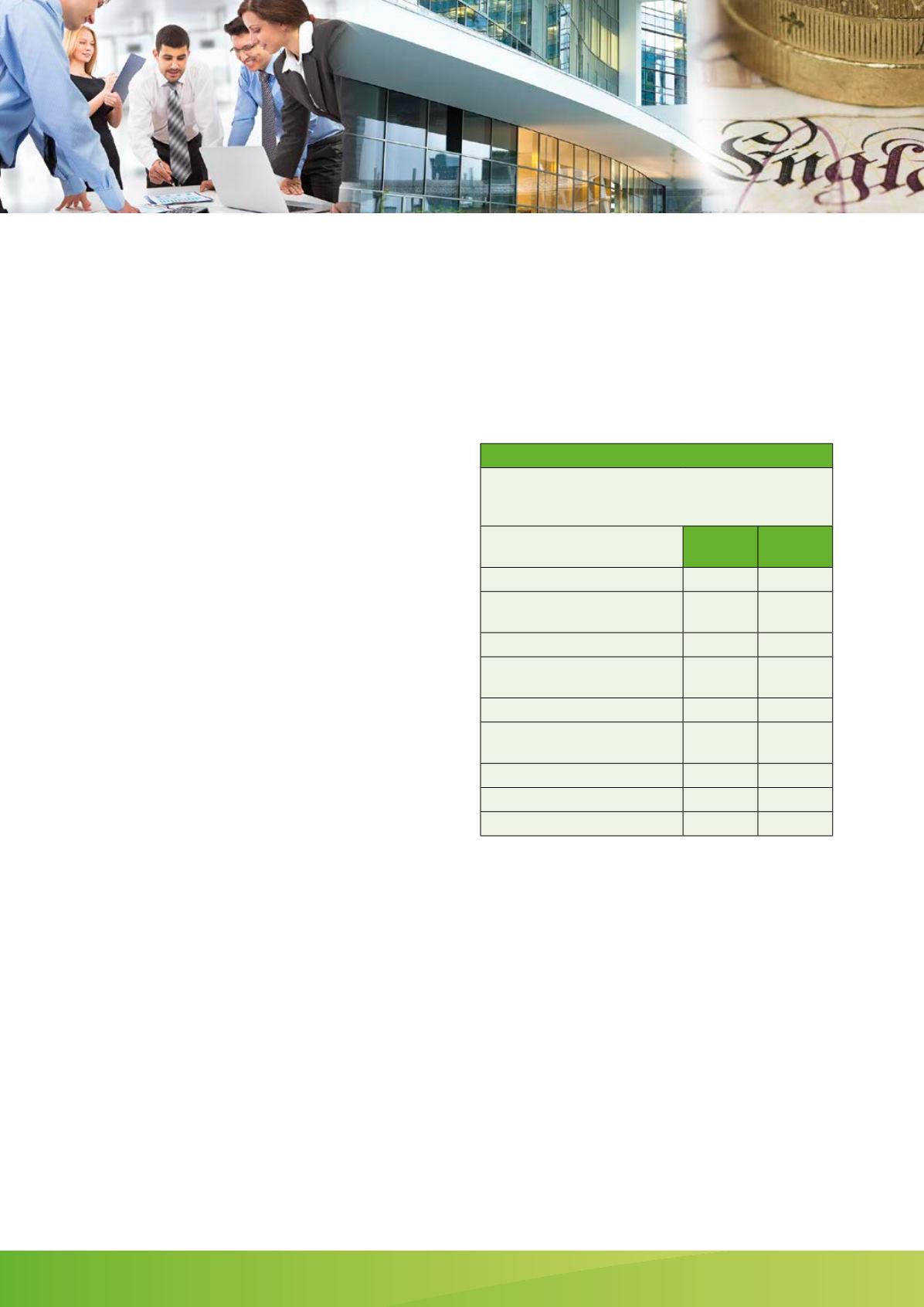

As an example, consider how much you might save if, as an

owner-director, you wanted to extract £10,000 profit (pre-tax)

your company makes in 2016/17 by way of a dividend rather

than a bonus. We have assumed in this scenario that the

director has already taken salary in excess of the upper earnings

limit for NIC, is a 40% taxpayer, and the £5,000 dividend tax

allowance has already been utilised.

Case Study

As you can see in this case study, the net income is increased

by 6% by opting to declare a dividend. Be sure to discuss this

with us, as this is a complex area of tax law.

Bonus

£

Dividend

£

Profit to extract

10,000

10,000

Employers’ NICs (13.8% on

gross bonus)

-1,213

Gross bonus

8,787

Corporation tax (20% - dividend is

not deductible for corporation tax)

-2,000

Dividend

8,000

Employees’ NICs (2% on

gross bonus)

-176

Income tax (40% on gross bonus)

-3,515

Income tax on dividend

-2,600

Net amount extracted

5,096

5,400

Remember that dividends are usually payable to all shareholders

and are not earnings for pension contributions and certain other

purposes. It is possible to waive dividends, although this can

result in tax complications. Finally, you need to consider with

us the effect of regular dividend payments on the valuation of

shares in your company.

Preparing for the year end

Tax and financial planning should be undertaken before the end

of your business year, rather than left until the end of the tax or

financial year. Some of the issues to consider include:

• the impact that accelerating expenditure into the current

financial year, or deferring it into the next, might have on

your tax position and financial results

• making additional pension contributions or reviewing your

pension arrangements

• how you might take profits from your business at the

smallest tax cost, and how the timing of payment of

dividends and bonuses can reduce or defer tax